- Friday, October 9th, 2009

- layer upon layer

-

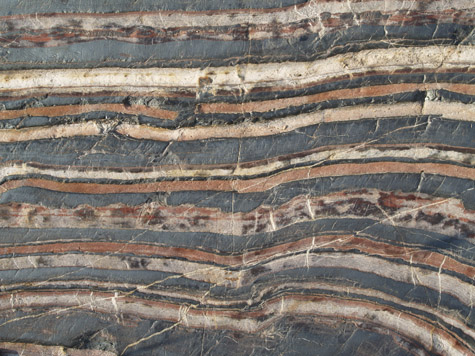

There are a few square yards of exposed rock in the Arrowhead region of Minnesota that look like this:

It is a geological puzzle: Layers of different kinds of rock, laid down more than a billion years ago, the whole formation then flipped on its side for us to examine. Great formative processes, apparently frozen in time. Students troop to the outcropping each summer to study and to wonder.

As observers of the market, we have quite a different task, to discern movements that are of the social sciences. Economics, sociology, and psychology dictate the patterns that we study and bet on — anthropology too. And maybe a bit of geology, when we stop to think about it.

Yes, the structures upon which we do our work are man-made, while the rocks came from somewhere else again. (Let’s not get into that discussion right now.) Is it bedrock upon which we can build or soft stone that will easily crumble away or even sand that will soon fall through that infamous hourglass? The questions linger and in some ways seem less likely to be addressed now than when we were in the throes of the Great Unwinding.

At the macro level, the debate goes on as to what the role of government ought to be in regulating market behavior. Read Steve Forbes, in the introduction to his magazine’s annual money porn issue celebrating the Four Hundred, and you will find that everything that went wrong could be traced to the government and its mistakes. There is no doubt that many of the layers of governmental action (and inaction) were ill advised, but that’s like looking at the photo above and only seeing the layers of one color. Champions of free markets failed just as miserably, because they talked a good game but did not play a good one.the research puzzle | Here’s an eight-part series on misplaced incentives I did earlier in the year; “one hand clapping” takes it to the buyers of crappy paper who didn’t do their work. There were many layers (and many players), and it’s so big picture that it’s almost impossible to get things done.

We should start a bit smaller, say with the rating agencies. I have written about them before.the research puzzle | Principally in “agents of record.” This is a great example of the sedimentation of actions: Unwise government rules about relying on ratings, reinforcement from plan sponsors and other overseers, dereliction of duty by the raters themselves, rapacious action by the financial engineers, and apparent obliviousness from financial professionals who bought the dreck. Layer after layer after layer. Bold action is needed now to start over, but it is not happening.

One need not look outward to apply the analogy, however. We so often don’t recognize the way our philosophies and opinions have been built over time. Why is your firm structured as it is? Why is your investing methodology the one that you have chosen? Why do you expect the market to do the things you expect it to do?

Layer upon layer. Sometimes you just need a geologist to come along and figure out what must have happened to create the pattern. Redoing a firm or a strategy or a market position is not easy. But it is about time.