-

- Monday, December 16th, 2019

- technical debt

-

I am always on the lookout for new concepts to use in the analysis of organizations. Often they originate in other disciplines, but can be applied or adapted for use in my consulting work and training sessions (such as my due diligence workshops, the next of which was just announcedtjb research | This one will have some new wrinkles.).

In the case of “technical debt,” much of the work was done for me by Mawer Investment Management. A November podcastMawer Investment Management | The podcast page has a link to the transcript of it, as well as others to related blog postings. from the firm explores technical debt and its implications for both the investment and operating decisions of asset management firms. In this posting, I also link it more broadly to other kinds of organizations in the investment world.

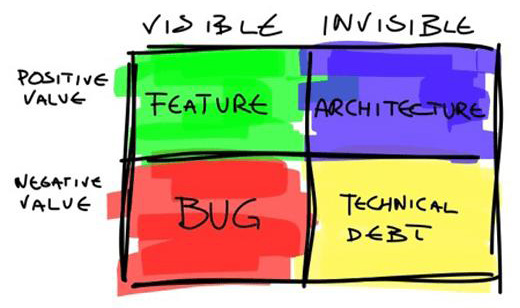

To start, here’s a graphic from CIO New Zealand:CIO New Zealand | It appeared in this posting.

Ignore for a minute the words inside the grid. In evaluating ... continues

-

- Monday, September 30th, 2019

- narratives everywhere

-

If you’ve followed my writing or been at one of my presentations, you know that I’m hung up on the narratives that pervade the investment ecosystem.

A posting from five years agothe research puzzle | It was titled, “cracking the narrative.” outlined the need for asset managers to craft an “effective and truthful” narrative, while stating that the main job of the allocators of capital is to crack that narrative.

My subsequent speech at a CFA conferencetjb research | Here is the transcript. included the word “narrative” sixteen times during a relatively short section (among them, referencing asset management firms as “narrative-creation machines”), and my workshopstjb research | I offer both public workshops and customized ones for individual organizations. on due diligence and manager selection offer strategies to sort the real process, philosophy, culture, etc. from the marketed version.

Like I said, I’m hung up on ... continues

-

- Wednesday, August 14th, 2019

- the future of analysis

-

In a previous posting,the research puzzle | The posting, “mind the gaps,” was written after my attendance (and presentation) at the 2019 CFA Institute annual conference in London. I wrote that when it comes to manager research, one “field of opportunity is the broad category of intelligence analysis, including innovations and improvements in the processes of investigation and decision making.” The same statement could be applied just as easily to other functions within the investment world.

I was reminded of it when reading “The Future of Analysis,”CIA | The paper may be downloaded here. which was written by Joseph Gartin, the deputy associate director of learning for the Central Intelligence Agency. It opens with this sentence, “The field of intelligence analysis is at an inflection point.”

As I read it, I was struck by how well Gartin’s paper — about “providing an advantage in the planning and execution of ... continues

-

- Wednesday, July 24th, 2019

- pay to play

-

Depending on the part of the investment world that you’re involved in, “pay to play” can mean a variety of different things. At the core of most of the situations is a payment for access to and potential influence of those charged with stewarding capital of behalf of others. A variety of intermediaries can be involved; in each of the cases below, asset managers play a role, as do other parties.

Let’s start with investment conferences. The attendees at some may be in the “institutional” realm, investing on behalf of pension plans, foundations, endowments, etc. Other conferences are aimed at the financial advisors who work with individual investors.

Many of the conferences are largely or completely pay to play. The agendas are packed with those who have bought sponsorships, which include the right to present their ideas (read: products and services) to the attendees — and their wishes can also shape the other topics that are deemed to ... continues

-

- Thursday, May 23rd, 2019

- mind the gaps

-

According to Wikipedia, “mind the gap” is “an audible or visual warning phrase issued to rail passengers to take caution while crossing the horizontal, and in some cases vertical, spatial gap between the train door and the station platform.” If you’ve visited London, you’ve undoubtedly had the phrase imprinted on your brain for some time, given its ubiquity there.

Fittingly, attending and speaking at the CFA Institute Annual Conference in London last week got me thinking about all kinds of gaps.

Sessions throughout the event — the theme of which was “disruption” — dealt with some of the biggest gaps that we face today. Climate change, sustainability, and ESG were a heavy focus throughout (including being addressed by Prince Charles in his video message to the attendeesYouTube | Here is that message.). Geopolitical issues and demographic trends got attention too.

A decade after the financial crisis, there remains a large ... continues